Estate Planning Scenarios: Asset Estate Details

This page covers the following location(s) in NaviPlan:

Scenario Manager - Analyze Goals - Estate Planning - Asset Estate Details

Planning Objectives :: Procedures :: Screen Notes :: Related Information

Planning Objectives

How do I use the goal coverage graph and "What Are My Options?" (WAMO)?

How do I use the goal coverage graph and "What Are My Options?" (WAMO)?

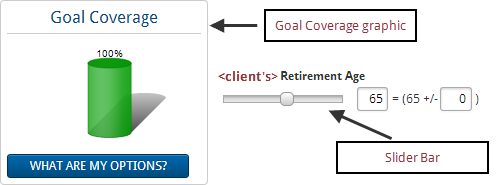

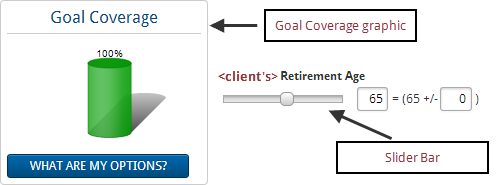

Goal Coverage graphics and Slider Bars

- On each goal page in the Scenario Manager you will find a Goal Coverage graphic and a set of slider bars. See an example of each below:

- Goal Coverage is the percentage of all cash outflows allocated to the goal that can be covered using all resources allocated towards the goal.

- The Goal Coverage graphic indicates what portion of the clients' goal is projected to be adequately funded in the selected scenario.

- The slider bars allow you to easily modify some of the major factors that go into this projection. Drag the slider bar to the right or left to change the value.

- Alternatively, you may also type values into the associated text fields.

- Important! When you make changes to slider bars the rest of the selected scenario will update according to your changes.

For example, adding $225 to the Additional Monthly Savings slider bar for the retirement goal will create a savings strategy for $225 on the Strategies page in the Scenario Manager for the selected scenario.

What Are My Options? (WAMO)

- NaviPlan allows you to make changes to many variables associated with your clients' goal. This allows you to create highly customizable and detailed plans. However, creating an optimal scenario can be difficult with so many options.

- You can click What Are My Options? to get a list of solutions for the current goal. Each solution will result in 100% Goal Coverage.

- You can select one of the presented options—or—you can go back to the goal screen and create a strategy that uses a combination of the strategies suggested by NaviPlan.

For example, selecting What Are My Options? for a retirement goal may result in a suggestion to save more monthly, retire later, or to save a large lump sum today. If these options are not feasible for your clients, you can go back to the goal page and recommend a combination of all three; save a smaller sum today, save a smaller amount monthly, and retire only a short time later than originally planned. In either case, the What Are My Options? feature can add value.

- WAMO calculations are useful even when a goal is adequately funded or overfunded.

- In the case of an adequately funded goal, WAMO can still be used to find optimal allocations for the goal.

- In the case of an overfunded goal, WAMO will show the amount needed to adequately fund the goal, allowing you to leverage the remaining value elsewhere.

How do I override information in the Scenario Manager?

How do I override information in the Scenario Manager?

- The Scenario Manager reflects the information entered in the clients' current plan. To override this information with scenario-specific assumptions and strategies select the Override option for the appropriate item.

- The Override option will appear in one of two ways in the Scenario Manager:

- As an unlabeled check box beside a disabled field:

.

. - As a labeled check box:

.

.

- Once you have selected Override, the relevant fields will become editable.

- Clearing the Override option will undo any changes you have made and revert information back to match the Current Plan scenario.

What can I do on this page?

What can I do on this page?

- The Asset Estate Details subtab is used to:

- modify the distribution of the estate as either a dollar or percentage value.

- modify bequests of specific assets on the client’s or co-client’s death.

- modify the details of any testamentary trusts applicable for a scenario.

- Bequests and testamentary trusts cannot be entered in Simple Will type scenarios.

- Use the Asset Estate Details subtab to change assumptions about how assets will be disposed of after death.

Procedures

How do I edit my clients' life expectancies?

How do I edit my clients' life expectancies?

- From the Estate Planning section, select Edit Life Expectancy.

- Select one of the following options for defining life expectancy:

- Simultaneous Death: Select this option to model the clients both dying simultaneously in a given year.

Note: If you select this option, NaviPlan displays separate Estate Distribution subtabs for the client and co-client. - Other Life Expectancies: Select this option to define separate life expectancies for the client and co-client. Make a selection from the menu and—if applicable—add an offset in the +/- field.

- When you are satisfied with these options, click OK.

How do I modify asset estate details?

How do I modify asset estate details?

- From the Asset Estate Details subtab, select Override.

- To re-title a non-qualified or lifestyle asset, select a new owner from the New Owner list under Non-Qualifiedand Lifestyle.

- Use the Probate Fees and Admin Fees options for each asset to indicate whether probate or administration fees apply.

- By default, all options are selected for all assets. However, probate and administration fees are not charged for joint assets on the first death, nor for any qualified assets listed, even though these check boxes are selected by default. By default, probate and administration fees are applied to annuity assets on the second death where the surviving co-client is listed as the beneficiary.

- Specify a primary and/or contingent beneficiary.

- For qualified accounts and annuities, if a contingent beneficiary other than the co-client is selected for a qualified asset, select the Multi-Generational option to set IRD taxes to zero.

How do I model a stretch (multi-generational) qualified asset?

How do I model a stretch (multi-generational) qualified asset?

- Change the primary beneficiary for a qualified asset to someone other than the client or co-client.

- Select the Multi-Generational option for the selected asset. When the owner of the asset dies, the asset will pass to the beneficiary (and not to the client or co-client).

Note: Estate taxes may be due, but IRD taxes will be avoided.

Screen Notes

Living Trust

Living Trust

- Use this option to prevent probate from being assessed against all assets in the client's and co-client's gross estate.

Related Information

NaviPlan is a registered trademark of Advicent Solutions, Inc.

.

. .

.