Retirement Scenarios: Liquidation Order

This page covers the following location(s) in NaviPlan:

Scenario Manager - Analyze Goals - Retirement - Liquidation Order

Planning Objectives :: Procedures :: Screen Notes :: Related Information

Planning Objectives

How do I use the goal coverage graph and "What Are My Options?" (WAMO)?

How do I use the goal coverage graph and "What Are My Options?" (WAMO)?

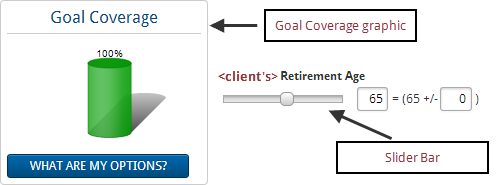

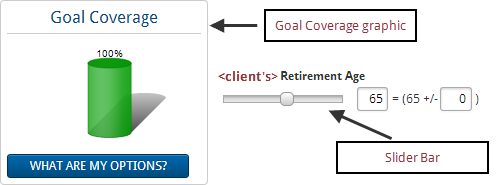

Goal Coverage graphics and Slider Bars

- On each goal page in the Scenario Manager you will find a Goal Coverage graphic and a set of slider bars. See an example of each below:

- Goal Coverage is the percentage of all cash outflows allocated to the goal that can be covered using all resources allocated towards the goal.

- The Goal Coverage graphic indicates what portion of the clients' goal is projected to be adequately funded in the selected scenario.

- The slider bars allow you to easily modify some of the major factors that go into this projection. Drag the slider bar to the right or left to change the value.

- Alternatively, you may also type values into the associated text fields.

- Important! When you make changes to slider bars the rest of the selected scenario will update according to your changes.

For example, adding $225 to the Additional Monthly Savings slider bar for the retirement goal will create a savings strategy for $225 on the Strategies page in the Scenario Manager for the selected scenario.

What Are My Options? (WAMO)

- NaviPlan allows you to make changes to many variables associated with your clients' goal. This allows you to create highly customizable and detailed plans. However, creating an optimal scenario can be difficult with so many options.

- You can click What Are My Options? to get a list of solutions for the current goal. Each solution will result in 100% Goal Coverage.

- You can select one of the presented options—or—you can go back to the goal screen and create a strategy that uses a combination of the strategies suggested by NaviPlan.

For example, selecting What Are My Options? for a retirement goal may result in a suggestion to save more monthly, retire later, or to save a large lump sum today. If these options are not feasible for your clients, you can go back to the goal page and recommend a combination of all three; save a smaller sum today, save a smaller amount monthly, and retire only a short time later than originally planned. In either case, the What Are My Options? feature can add value.

- WAMO calculations are useful even when a goal is adequately funded or overfunded.

- In the case of an adequately funded goal, WAMO can still be used to find optimal allocations for the goal.

- In the case of an overfunded goal, WAMO will show the amount needed to adequately fund the goal, allowing you to leverage the remaining value elsewhere.

How do I override information in the Scenario Manager?

How do I override information in the Scenario Manager?

- The Scenario Manager reflects the information entered in the clients' current plan. To override this information with scenario-specific assumptions and strategies select the Override option for the appropriate item.

- The Override option will appear in one of two ways in the Scenario Manager:

- As an unlabeled check box beside a disabled field:

.

. - As a labeled check box:

.

.

- Once you have selected Override, the relevant fields will become editable.

- Clearing the Override option will undo any changes you have made and revert information back to match the Current Plan scenario.

What factors should I consider when defining retirement account liquidation order?

What factors should I consider when defining retirement account liquidation order?

Account Values

- Accounts in the custom account liquidation order list are valued according to the following situations:

| Situation: | Account will be valued: |

|---|

| Client and co-client are both in pre-retirement | At first retirement |

| One client is in retirement | As of the plan date |

| Both clients are in retirement | As of the plan date |

| Both clients deceased before retirement date | At first retirement |

| Client is retired with a date of death before the retirement of the co-client | As of the plan date |

| Client has retired and is deceased, and co-client has not reached retirement | At the retirement date of the co-client |

Account Residuals

- Non-qualified accounts that are fully funding other goals appear in the account list, but only the residual portion is available to redeem.

- If the goal that the account is funding occurs at a date later than retirement, the account still appears in the list and can be moved to the top of the list, but no redemptions will occur until the residual is available. Once the residual becomes available, this account will be redeemed.

For example, an account with a value of $100,000 is moved to the top of the list to fund a $90,000 purchase—which will happen five years into retirement. After the purchase occurs, $10,000 remains. This residual amount will now be used to fund the retirement goal. Since the purchase account was moved to the top of the list, the $10,000 will be redeemed but will only be available after the purchase goal has been achieved.

529 Plans and Coverdell accounts

- 529 plans and Coverdell accounts, which can only be used to fund an education goal and whose residuals will flow into the estate, do not appear in the account list.

Accounts fully funding the Emergency Fund goal

- Accounts that are fully funding an emergency fund goal do not appear in the account list. Even if only a partial amount of an account funding an emergency fund goal was used, the remainder stays linked to the emergency fund goal.

Accounts partially funding the retirement goal

- If an account is only partially funding the retirement goal, then only the partial amount (and a residual, if applicable) is used in the calculations.

For example, if an account is linked 50% to retirement, 20% to a major purchase goal, and 30% to an education goal, then only the 50% that is linked to retirement will be available to redeem. Once the major purchase goal and the education goal have been achieved, and there is a residual left, the residual is then used to fund retirement.

Annuities

- Annuities are available for liquidation with the following exceptions:

- Annuities that will annuitize at a date during retirement will appear in the account list and can be moved up in the order, but redemption will only be available until the annuitization date (unless the annuity type is Withdrawals as Needed).

- Annuities that annuitize at retirement will not be available in the account list except those with the annuity type of Withdrawals as Needed.

- Annuitized annuities will not be available in the account list.

Time horizon

- If an account is not currently available to fund the goal, but has been placed in a high priority for liquidation, this account will not be redeemed until it is available to fund the goal.

For example, if the client retires before the co-client, and one of the co-client’s retirement accounts has been placed at the beginning of the liquidation order list, accounts below the co-client’s retirement account will be redeemed until the time period for the first account is reached. At that point, the co-client’s retirement account will be redeemed.

System-generated accounts

- System-generated accounts do not appear in the account list, but will be used in the following manner:

- If the predefined method is used, system-generated accounts are grouped with other similar account types.

- If the custom liquidation order method is used, system-generated accounts are used before the first account in the account list.

Unallocated accounts

- Although NaviPlan does not use the principal from unallocated accounts to meet retirement needs, the investment income from these accounts can affect Goal Coverage and What Are My Options? calculations.

- Because investment income (except tax-free returns) earned by non-qualified accounts is subject to tax, it is assumed that the tax is paid from the account with the estimated net or after-tax amount reinvested. NaviPlan models the reinvestment of income as follows:

- Gross amount of the investment income is included as a cash inflow.

- NaviPlan estimates the tax due on the investment income by applying the marginal tax rate to the income.

- Note: This estimate does not consider tax-related items such as deductions or credits.

- NaviPlan reinvests the estimated net amount in the account (gross amount minus estimated tax) as a cash outflow.

- When the taxes calculated for the plan are lower than the estimated taxes due on the investment income, a surplus can occur. NaviPlan will use this surplus to meet retirement income needs.

- When calculating goal coverage, NaviPlan considers the after-tax income as retirement income. When calculating What Are My Options?, NaviPlan suggests an increased expense amount such that the surplus meets the established cash flow tolerance.

Procedures

How do I modify the retirement liquidation order for a scenario?

How do I modify the retirement liquidation order for a scenario?

- From the Liquidation Order section, select the appropriate Override option for <client> and/or <co-client>.

- Select the Calendar (

) and choose an event for redemptions to begin.

) and choose an event for redemptions to begin.

Note: You can also define a number of years by which to offset the selected event.

For example, selecting Retirement with an offset of +5 years will bring redemptions five years after your client retires.

Screen Notes

Scenario Reports

Scenario Reports

- Scenario reports analyze detailed information related to the selected scenario.

- The exact information shown depends on the goal and which report you choose to run.

- For more information, see the Scenario Reports Help page.

Compare Scenarios

Compare Scenarios

- Use Compare Scenarios to quickly get detailed comparison information for a single goal from two scenarios.

- The exact information shown depends on the goal.

- For more information, see the Compare Scenarios Help Page.

Related Information

NaviPlan is a registered trademark of Advicent Solutions, Inc.

.

. .

. ) and choose an event for redemptions to begin.

) and choose an event for redemptions to begin.